Following Budget 2025 (admittedly delivered prematurely by the Office of Budget Responsibility thanks to a technical error), here is an overview of what we believe are the most relevant and significant announcements for businesses and residents across the West Midlands region.

Growing the Regional Economy

The West Midlands is a Mayoral Strategic Authority (MSA) and has been at the forefront of the country’s devolution agenda since 2015. Whilst the devolution agenda is being accelerated by the Government, the West Midlands – alongside Greater Manchester – is at the forefront of how regional governance is being delivered in England. Here are some of the ways in which the Government intends to work with the Mayor and the West Midlands Combined Authority to drive regional investment and growth in the economy.

Integrated Settlement Funding: The West Midlands is confirmed as one of seven MSAs to receive an integrated settlement of at least £13 billion in funding from 2026-27 to 2029-30. This empowers the Mayor with local control over a single flexible pot of money for growth and public service priorities, aligned with the region’s local growth plans.

In his reaction to the Budget, Richard Parker (Mayor of the West Midlands) shared via social media his plans for the funds:

“For the West Midlands, the total package announced is £2.5bn for growth and opportunity. It’s a big number, but the impact will be very real.

Here’s what we’ll do with some of that money that will help businesses, families and everyone across our region:

– £530m for skills and employment support – helping people move into good, well-paid jobs with a future

– £177m for new homes – including social and affordable housing, because a secure home is the bedrock of a stable life

– £232m for business support and regeneration – backing our high streets, town centres and local entrepreneurs

– £96m to cut energy bills – supporting home upgrades that make a noticeable difference to household budgets

– £36m for active travel – making it easier and safer for people to walk, cycle and live healthier lives”

Local Growth Fund: The region is one of the 11 mayoral city regions in the North and Midlands that will receive a share of a new £902 million local growth fund over four years to invest in key local growth projects.

Mayoral Revolving Growth Fund: As an MSA with an integrated settlement, the West Midlands will benefit from the £500 million Mayoral Revolving Growth Fund. This fund is designed to allow the Mayor to invest in “game-changing growth projects” alongside the private sector, specifically to break down regional access to finance barriers for businesses.

Accelerated Priority Projects: The government is launching an initiative to accelerate the delivery of priority projects in the West Midlands (alongside Greater Manchester, West Yorkshire, and Glasgow City Region) with support from public investment institutions. In essence, “Accelerated Priority Projects” is a commitment to provide targeted, hands-on support from central public finance bodies to ensure major local infrastructure and development schemes in the West Midlands are delivered faster than they otherwise would be.

Place-Based Investment Reform: Birmingham has been announced as one of the early adopters of “place-based business cases” as the government reforms central decision-making processes to put place at the heart of investment planning. This is important for the region in the sense that instead of appraising funding applications for single, isolated projects (like a new road or a new housing development), this new approach allows Birmingham’s authorities to submit a business case for a portfolio of complementary interventions in a specific area.

Being an early adopter ‘should’ enable Birmingham to be at the forefront of this new approach. It positions the city to cut red tape and speed up planning, funding, and delivery of its major infrastructure projects by integrating them into a single, cohesive investment strategy. This reform is intended to accelerate “game-changing projects” like the Sports Quarter and Coventry’s Greenpower Park by providing a clear, government-backed framework for their delivery.

The health of the region is also in the spotlight with Capital investment in the NHS being boosted by £300 million to support the creation of 250 new Neighbourhood Health Centres to help cut waiting lists in England and there are several specific locations in the West Midlands that will be among the first to benefit, either through new construction or major upgrades to existing facilities.

These centres are part of the broader Neighbourhood Health Service, which aims to shift care from hospitals to the community, focusing on areas with the greatest deprivation and health inequalities. The confirmed locations within the West Midlands are Stockland Green Primary Care Centre and Summerfield Primary Care Centre.

Policies which will directly impact businesses in the region

There are some broader, national policy announcements within the Budget which are also likely to impact businesses across the West Midlands region.

Here are some of the ‘headline-grabbers’:

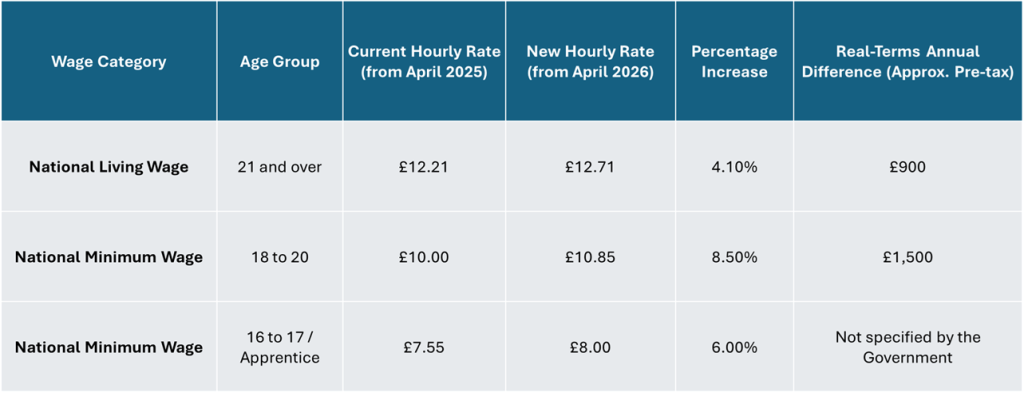

National Living and Minimum Wage

The increases in the National Living Wage (NLW) and National Minimum Wage (NMW) announced in the Budget 2025 will take effect from April 1, 2026. The increases are detailed below, which outlines the percentage and the equivalent real-terms annual difference (before tax) for a full-time worker in each category.

Youth Guarantee: This initiative is aimed at tackling youth unemployment and helping businesses access talent: “The government is making over £1.5 billion available across the spending review period into the Youth Guarantee and the Growth and Skills Levy. The Government’s aim is for The Youth Guarantee to ensure all young people aged 16-24 years old have access to the support they need to earn or learn.

Business Rates Reform: The government is introducing permanently lower business rates for certain high street sectors and introducing a new high-value multiplier. The policy is designed to boost high streets by benefitting from permanently lower business rates for retail, hospitality and leisure – funded by higher rates for the most expensive properties such as warehouses used by large online retailers.

Business Investment Incentives: Enterprise Management Incentives (EMI) Expansion: A tax incentive scheme for high-growth companies is being significantly expanded. “The government will increase the employee limit to 500, the gross assets test to £120 million, and the company share option limit to £6 million from April 2026.” This change is intended to allow scale-ups, as well as start-ups, to access the scheme.

Policies which will directly impact residents across the region

There has been an emphasis from the Government on attempting to tackle the ‘cost of living’ crisis and a number of policies have been announced designed to support families, and improve public services.

This includes:

- Household energy bills will see an average cost reduction of around £150 from April 2026.

- Regulated rail fares will be subject to a one-year freeze—the first in 30 years—saving commuters on more expensive routes more than £300 per year.

- The 5p fuel duty cut is extended until the end of August 2026.

- Prescription charges will also be frozen for one year, remaining at £9.90 for a single charge.

- The National Living Wage (NLW) will increase to £12.71 per hour in April 2026 for the lowest paid.

- The Youth Guarantee is backed by over £1.5 billion, ensuring all young people aged 16-24 have access to the support they need to earn or learn, tackling elevated rates of young people not in education, employment, or training (NEET).

- The two-child limit in Universal Credit (UC) is being scrapped, a measure expected to lift 450,000 children out of poverty nationwide.

What are your thoughts on Budget 2025? We are a non partisan think tank, focussed on helping to shape an even ‘better’ West Midlands.

Send your thoughts to research@thenewmidlands.org.uk